Project: Analyzing Stocks

In this project, we will focus on exploratory data analysis of stock prices for following companies from 2006 to 2015.

- Amazon

- Microsoft

- Bank of America

- Citibank

#Imports

import numpy as np

import pandas as pd

import pandas_datareader.data as web

import datetime as dt

#visualization libraries

import matplotlib.pyplot as plt

import seaborn as sns

#Start and end period

start = dt.datetime(2006,1,1)

end = dt.datetime(2016,1,1)

#Tickers of the companies

tickers = ['AMZN','MSFT','BAC','C']

#Fetch data from yahoo stocks using DataReader

amazon = web.DataReader('AMZN',data_source='yahoo',start=start,end=end)

microsoft = web.DataReader('MSFT',data_source='yahoo',start=start,end=end)

bank_of_america = web.DataReader('BAC',data_source='yahoo',start=start,end=end)

citigroup = web.DataReader('C',data_source='yahoo',start=start,end=end)

#Concating all the data frames of different companies into one large data frame.

stock_data = pd.concat([amazon,microsoft,bank_of_america,citigroup],axis=1,keys=tickers)

#Adding column names

stock_data.columns.names = ['Tickers','Stock Info']

#Glimpse of data

stock_data.head()

| Tickers | AMZN | MSFT | BAC | C | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stock Info | High | Low | Open | Close | Volume | Adj Close | High | Low | Open | Close | Volume | Adj Close | High | Low | Open | Close | Volume | Adj Close | High | Low | Open | Close | Volume | Adj Close |

| Date | ||||||||||||||||||||||||

| 2006-01-03 | 47.849998 | 46.250000 | 47.470001 | 47.580002 | 7582200 | 47.580002 | 27.000000 | 26.10 | 26.250000 | 26.840000 | 79973000.0 | 19.602528 | 47.180000 | 46.150002 | 46.919998 | 47.080002 | 16296700.0 | 35.298687 | 493.799988 | 481.100006 | 490.000000 | 492.899994 | 1537600.0 | 440.882477 |

| 2006-01-04 | 47.730000 | 46.689999 | 47.490002 | 47.250000 | 7440900 | 47.250000 | 27.080000 | 26.77 | 26.770000 | 26.969999 | 57975600.0 | 19.697485 | 47.240002 | 46.450001 | 47.000000 | 46.580002 | 17757900.0 | 34.923801 | 491.000000 | 483.500000 | 488.600006 | 483.799988 | 1870900.0 | 432.742950 |

| 2006-01-05 | 48.200001 | 47.110001 | 47.160000 | 47.650002 | 5417200 | 47.650002 | 27.129999 | 26.91 | 26.959999 | 26.990000 | 48245500.0 | 19.712091 | 46.830002 | 46.320000 | 46.580002 | 46.639999 | 14970700.0 | 34.968796 | 487.799988 | 484.000000 | 484.399994 | 486.200012 | 1143100.0 | 434.889679 |

| 2006-01-06 | 48.580002 | 47.320000 | 47.970001 | 47.869999 | 6152900 | 47.869999 | 27.000000 | 26.49 | 26.889999 | 26.910000 | 100963000.0 | 19.653666 | 46.910000 | 46.349998 | 46.799999 | 46.570000 | 12599800.0 | 34.916302 | 489.000000 | 482.000000 | 488.799988 | 486.200012 | 1370200.0 | 434.889679 |

| 2006-01-09 | 47.099998 | 46.400002 | 46.549999 | 47.080002 | 8943100 | 47.080002 | 27.070000 | 26.76 | 26.930000 | 26.860001 | 55625000.0 | 19.617136 | 46.970001 | 46.360001 | 46.720001 | 46.599998 | 15619400.0 | 34.938789 | 487.399994 | 483.000000 | 486.000000 | 483.899994 | 1680700.0 | 432.832489 |

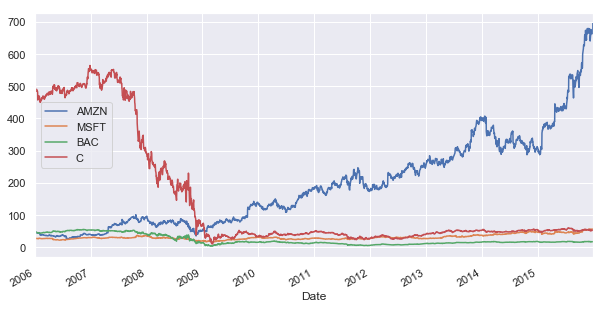

#Max close price for each company's stock

stock_data.xs(key='Close',level='Stock Info',axis=1).max()

Tickers

AMZN 693.969971

MSFT 56.549999

BAC 54.900002

C 564.099976

dtype: float64

#Return of each company

returns = pd.DataFrame()

for ticker in tickers:

returns[ticker] = stock_data[ticker]['Close'].pct_change()

returns.head()

| AMZN | MSFT | BAC | C | |

|---|---|---|---|---|

| Date | ||||

| 2006-01-03 | NaN | NaN | NaN | NaN |

| 2006-01-04 | -0.006936 | 0.004843 | -0.010620 | -0.018462 |

| 2006-01-05 | 0.008466 | 0.000742 | 0.001288 | 0.004961 |

| 2006-01-06 | 0.004617 | -0.002964 | -0.001501 | 0.000000 |

| 2006-01-09 | -0.016503 | -0.001858 | 0.000644 | -0.004731 |

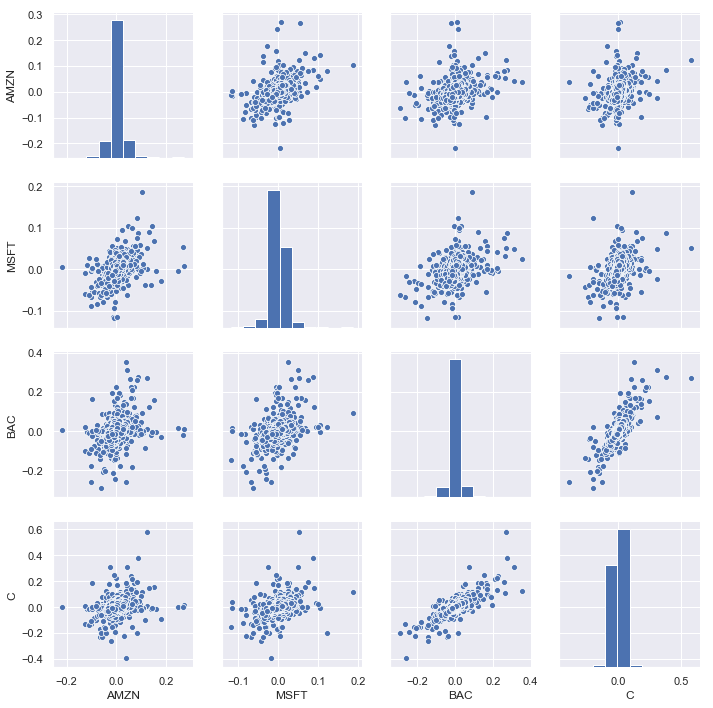

sns.pairplot(returns)

<seaborn.axisgrid.PairGrid at 0x1877dbb83c8>

#Worst return date for each company

returns.idxmin()

AMZN 2006-07-26

MSFT 2009-01-22

BAC 2009-01-20

C 2009-02-27

dtype: datetime64[ns]

#Best return date for each company

returns.idxmax()

AMZN 2007-04-25

MSFT 2008-10-13

BAC 2009-04-09

C 2008-11-24

dtype: datetime64[ns]

#Standard deviation of returns

returns.std()

AMZN 0.026638

MSFT 0.017764

BAC 0.036647

C 0.038672

dtype: float64

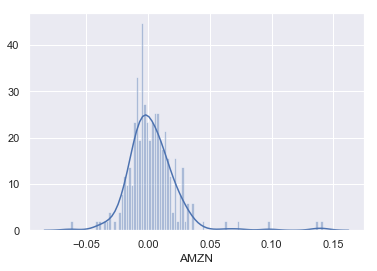

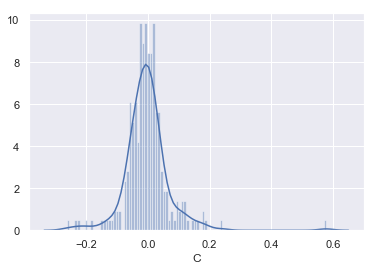

#Standard deviation of returns for year 2015

returns.loc['2015-01-01':'2015-12-31'].std()

AMZN 0.021147

MSFT 0.017801

BAC 0.016163

C 0.015289

dtype: float64

#Lets create distribution plot of the stock returns of Amazon for year 2015

sns.distplot(returns.loc['2015-01-01':'2015-12-31']['AMZN'],bins=100)

<matplotlib.axes._subplots.AxesSubplot at 0x1877f3e4588>

#Lets create distribution plot of the stock returns of Citigroup for year 2008

sns.distplot(returns.loc['2008-01-01':'2008-12-31']['C'],bins=100)

<matplotlib.axes._subplots.AxesSubplot at 0x187009ce518>

#Close price of each company throughout the entire time period of 2006-2015

stock_data.xs(key='Close',axis=1,level='Stock Info').plot(figsize=(10,5))

plt.legend()

<matplotlib.legend.Legend at 0x1877fdf1278>

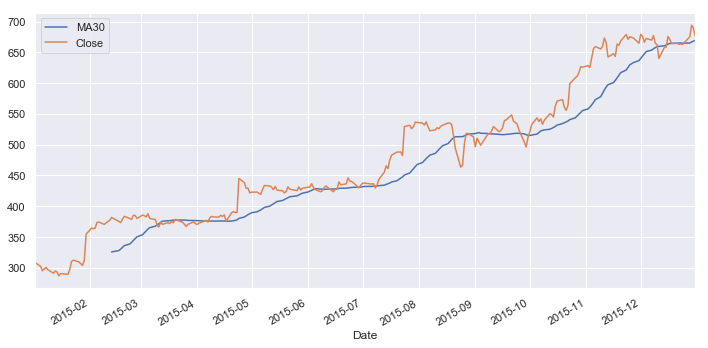

#30 day moving average of Amazon for year 2015

stock_data.loc['2015-1-1':'2015-12-31','AMZN']['Close'].rolling(30).mean().plot(figsize=(10,5),label='MA30')

stock_data.loc['2015-1-1':'2015-12-31','AMZN']['Close'].plot(label='Close')

plt.tight_layout()

plt.legend()

<matplotlib.legend.Legend at 0x1870483e048>

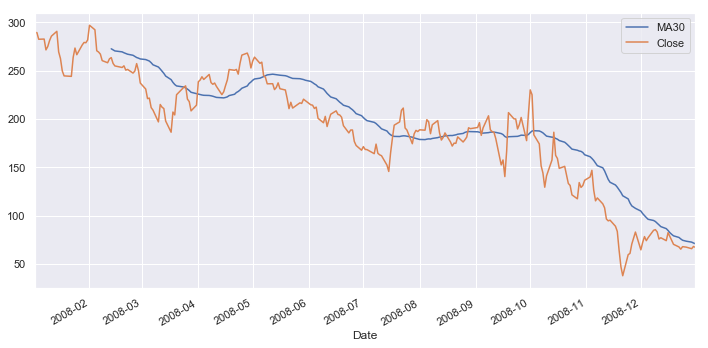

#30 day moving average of Citigroup for year 2008

stock_data.loc['2008-1-1':'2008-12-31','C']['Close'].rolling(30).mean().plot(figsize=(10,5),label='MA30')

stock_data.loc['2008-1-1':'2008-12-31','C']['Close'].plot(label='Close')

plt.tight_layout()

plt.legend()

<matplotlib.legend.Legend at 0x18704839898>

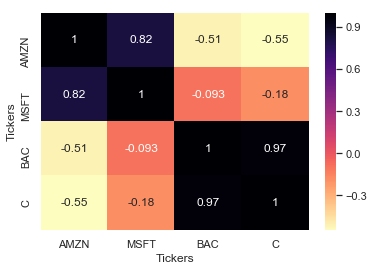

#Heatmap for the relation between close prices of different stocks

sns.heatmap(stock_data.xs(key='Close',axis=1,level='Stock Info').corr(),cmap='magma_r',annot=True)

<matplotlib.axes._subplots.AxesSubplot at 0x18704ae9a58>

Leave a comment